Now a decade old, our annual Marketing Leaders’ Benchmark shows that marketers are not letting the continued disruption of the pandemic derail their plans for a successful 2022. Alastair Beddow reports.

Predicting the future is inherently risky. Ten years ago – when PM Forum and Meridian West launched the first Marketing Leaders’ Benchmark survey – early warning signs of the trends that would come to define the last decade were already being felt.

In the intervening ten years, professional firms have been grappling with interconnected trends: the rapid pace of technology adoption and its smarter integration into service delivery, the fragmented competitor landscape, the redrawing of expectations about client service experience and value for money.

Back in 2012, however, even the most accurate prophet would have been unlikely to anticipate the seismic shifts we have all experienced during the past two years. At this moment of our tenth annual benchmarking survey, therefore, we look ahead to how professional services marketers are using the disruption of the pandemic as a springboard for their future success.

An opportunity for transformation

The last 12 months have presented M&BD leaders with an opportunity to rethink how their firm markets its expertise, wins new business, and manages its client relationships. Many highlight the pivot to digital engagement as a key success over the last year, while others point to the resilience of their teams to deliver major projects – new brand initiatives, thought leadership campaigns, embedding new marketing technologies – in the face of continued market uncertainty.

Nearly half (49%) of the respondents in our latest benchmarking research say that 2021 was a ‘transformative’ year for their firm’s marketing function, an opportunity to experiment with new approaches. For a further third (35%), 2021 was a ‘rebounding’ experience having returned to a steady rhythm akin to pre-pandemic business as usual activity.

However, the experience hasn’t been universally positive. 8% in our benchmark survey say 2021 presented significant challenges for their firm, while 9% categorise their approach in 2021 as ‘treading water’, having to react fast and adapt their approach as they went along.

2022: more reasons to be optimistic?

Despite our most recent benchmark research taking place during the 2021 omicron surge, the survey respondents enter 2022 with a sense of optimism for the professional services sector. 61% anticipate conditions for the sector to improve, with just 5% saying that the year ahead will witness an overall decline for the sector.

Respondents are similarly confident about the prospects for their own firm: 97% believe the fortunes of their own firm will either improve or remain the same, with a majority (70%) anticipating the outlook for their specific firm to improve.

Our benchmark participants are less optimistic about the wider economy, with just 35% anticipating conditions in the general UK economy to improve this year. Nearly one in five (18%) anticipate conditions to deteriorate.

What gives marketing leaders the confidence that their performance in 2022 will outpace growth in the general economy? Our survey suggests marketing leaders believe they have the right ingredients in place to deliver impact this year against the backdrop of a challenging market.

Take, for example, the three primary areas of focus for marketing leaders this year: client experience improvement; market intelligence and thought leadership; and brand refresh. These are cited as the lead priority by 29%, 16% and 14% of survey respondents respectively.

Our survey results suggest that marketing leaders see 2022 as the right moment to follow through on the transformation agenda begun over the last two years. This is also reflected in the skills marketing leaders say they are looking to recruit or develop within their teams: they are looking for new hires who can continue to build momentum around refreshing the brand proposition, adopting new digital marketing channels, and embedding a more structured approach to client experience measurement and improvement.

Managing the hybrid challenge

Although marketing leaders believe they have plotted the right strategic course for the year ahead, they also recognise that executing that strategy presents many challenges. When asked about the three biggest challenges for their firm over the coming year, three related challenges emerge top of the list for market leaders in our survey. These are:

- The shift to hybrid working practices, cited by 29% as their biggest challenge, and by 61% among their top three challenges.

- Responding to digital disruption / keeping pace with new technology, cited by 13% as their biggest challenge, and by 62% among their top three challenges.

- Changing client expectations and buyer behaviour, cited by 18% as their biggest challenge and by 58% among their top three challenges.

Marketing leaders know that executing their strategic priorities will require collaboration, creativity and buy-in from the firm. All those things are more challenging in a hybrid working environment.

This is especially true now that expectations around working patterns have shifted. Only 3% of survey respondents said staff will work full time in the office once COVID restrictions are fully lifted. A majority (77%) say that staff can work from home but are either mandated (40%) or encouraged (37%) to work at least some of their time in the office. One in five (21%) say staff will be able to decide whether they work from the office or remotely, and how often.

Among those embracing hybrid working a majority, 60%, anticipate that staff will work remotely either three or four days each work, with only a minority of their time spent in the office.

Engaging clients in a digital world

Our benchmark survey also highlights a long-term shift in client engagement and event planning. When asked about their proposed event programme for 2022, firms say on average just under half (45%) of their events will be online only. A third (34%) are anticipated to be in-person only events and just one in five (21%) will be hybrid, offering attendees a choice of online or in-person engagement.

These results suggest that firms do not yet have the confidence in the technology or the format to facilitate effective hybrid events. Instead, marketing leaders say they are being smarter in their event planning and client engagement, experimenting with smaller group roundtables, online discussion communities and interactive online conferences.

Marketing budget: firms looking to reinvest for growth

Perhaps the biggest turnaround in our survey during the last year is the return of growth to M&BD budgets. Just 12 months ago nearly half (46%) of the benchmark participants anticipated a cut in their marketing budget. Today that figure has dropped to just 1%.

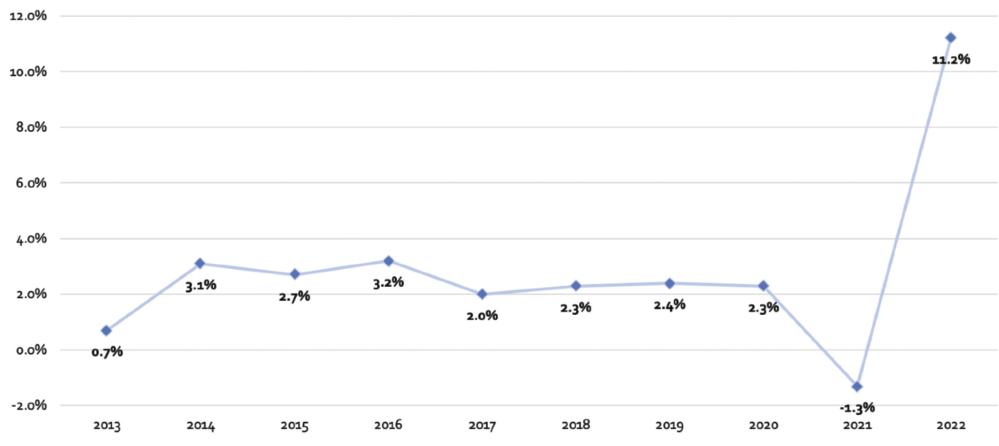

What is more encouraging is that marketing budgets are witnessing inflationary-beating rises intended to fuel investment in strategic marketing priorities. Among survey respondents, 54% anticipate growth in their marketing budget and 44% anticipate double digit growth. In 2022 the average marketing budget is set to rise by 11.2%, a dramatic turnaround from the average 1.3% decrease witnessed 12 months ago and a significant move from the low single digit budget increases seen prior to the pandemic.

Spending on marketing technology rising

Technology spend will be the biggest beneficiary of the overall increase in marketing budget. Among survey participants, 63% say they will increase spending on their social media and website. A further 55% will increase spending on business development technology and systems.

When asked what kind of technologies they will be investing in a range of use cases are commonly cited, including new or updated CRM systems, client listening technologies, marketing automation software (for example for pitch decks or email communications), and further investment in website and video production.

Turning uncertainty to advantage

This year’s marketing leaders benchmark clearly reveals that marketing leaders are starting 2022 with a strong tail wind: greater spending power, a resilient business model and a clear set of achievable priorities. Confidence is riding high among the professional services sector, and now is the time to overturn the uncertainty of the last two years to pursue the opportunities that lie ahead.